News Corp to split biz into news and entertainment units

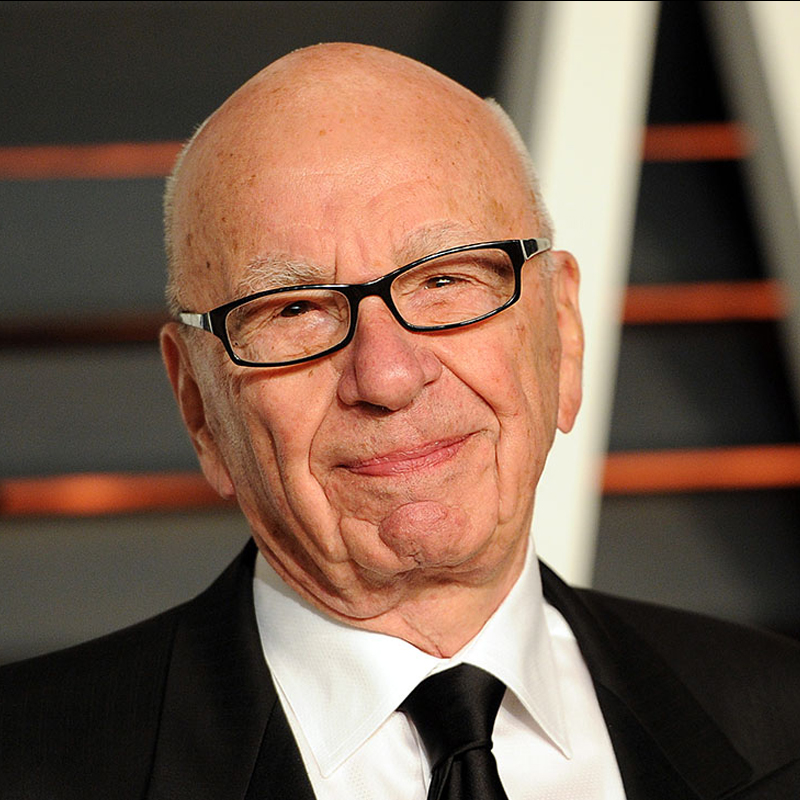

MUMBAI: Rupert Murdoch-controlled News Corporation has decided to split its business into two entities separating its film & television business from the publishing business.

While most shareholders see the UK newspaper assets as a liability, Murdoch wants them.

Investors had every reason to cheer as the film and television vertical contributes about 75 per cent of the company?s revenue overall while the publishing business was a drag on the conglomerates bottom line. News Corp?s film and television business includes Fox News Channel and Fox Business Network, Star Television, Fox Broadcasting Company, BSkyB and 20th Century Fox.

Publishing, including The Wall Street Journal, the Times of London, New York Post and Australian newspaper, accounts for about 18 per cent of News Corp?s operating income.

?News Corporation confirmed today that it is considering a restructuring to separate its business into two distinct publicly traded companies,? the company said in a brief statement without specifying any details.

The announcement was hailed by investors with the company?s stock rising up 8.3 percent, to close at $21.76 Tuesday. During the day, the stock reached $21.89, its best performance in more than four and a half years.

Business fundamentals apart, the Rupert Murdoch owned media and entertainment conglomerate was also concerned about the wider implications of the phone hacking scandal at the UK publishing subsidiary.

The scandal had already led to the closure of News of the World besides, forcing News Corp to abort its takeover of profitable pay TV business BSkyB, where it holds 39 per cent ownership.

British communications regulator Ofcom is in final stages of its review of whether News Corp deputy COO is "fit and proper" to hold a broadcast license.