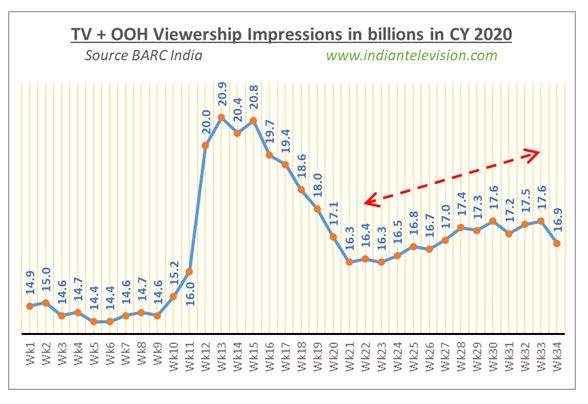

BENGALURU: Television viewership in terms of weekly impressions declined 3.98 percent in Week 34 of 2020 (Week 34: Saturday, 22 August 2020 to Friday, 28 August 2020, week or period under review) as compared to the immediate previous week 33. Per Broadcast Audience Research Council of India (BARC) weekly data in the public domain, overall TV+OOH viewership in Week 34 of 2020 was 16.9 billion weekly impressions as compared to 17.6 billion weekly impressions in Week 33. After a steady increase since Unlock 1.0 (Week 22 of 2020), the drop of 0.7 billion impressions was the steepest one since the country opened up after the Covid2019 Lockdown that had commenced on 25 March 2020 or midweek in Week 13 of 2020. At that time, home-tied Indians turned to the easiest and most accessible medium for live news. Indians wanted to know more and more about the new pandemic that had forced most of the world to suddenly stop. Television viewership shot up to 20.9 billion impressions in Week 14 of 2020, with the News genre recording the largest growth, while GEC viewership slid down. Four genres – GEC, Movies, News and Kids are normally responsible for more than 90 percent of television viewership. The breakup for the COVID2019 average between Weeks 2 to 4 of 2020 was: GEC at 52 percent, Movies at 23 percent, and News and Kids at 7 percent each, or a combined total of 89 percent. The breakup of the combined total of 94 percent for these four genres in Week 13 of 2020 was GEC 40 percent, Movies 29 percent, News 18 percent and Kids 7 percent. It must be noted that overall television viewership had climbed up

Despite the drop in Week 34 of 2020, TV viewership based on weekly impressions in Week 34 of 2020 was 1.4 percent more than the average of Weeks 2 to 4 of 2020 of 14.8 billion weekly impressions. The current ratings agency BARC along with the older one Nielsen commenced editions of “Crisis Consumption - Impact Of COVID -19 On TV And Smartphone Behaviour Across India”. At the time of writing of this paper, eleven editions have been released by BARC-Nielsen. The ratings duo has standardized the average data for Weeks 2 to 4 of 2020 as a measure for television consumption trends. The author has also used the same yardstick to analyze television consumption trends of the Top channels based on BARC weekly data published each week in the public domain of the top 2 or 3 or 4 or 5 or 10 Television channels of each genre, sub-genre, language and/or platform in all-India or the respective market, The analysis of this paper is limited to that extent. Where required, data from the 11 editions released by BARC-Nielsen has been used. Though the percentages of share of consumption may differ from the numbers in the BARC-Nielsen reports and those arrived at by the author based on limited BARC data available in the public domain, BARCs’ historical conclusions generally conform with them. Please refer to the figure below for TV+OOH viewership data as per BARC Weekly data.

Viewership share of GECs’ has been growing post Week 22 of 2020 per the latest BARC-Nielsen report which included data for Week 33 of 2020. Week 22 of 2020 was when a number of genres started creating fresh content after UNLOCK 1.0 commenced. Viewership share of GECs’ was 52 percent of overall television in Week 33 of 2020 which is at par with the Pre-COVID2019 average (average of Weeks 2 to 4 of 2020). In Week 12 of 2020, it had plunged to an all-time low of 39 percent. The 11th edition of the BARC-Nielsen report that included data for Week 33 of 2020 revealed that the overall television viewership of 17.6 billion impressions was still 22 percent higher than the pre-COVID2019 viewership. The breakup of growth in viewership between the HSM and South in Week 33 of 2020 was 24 percent and 17 percent respectively.

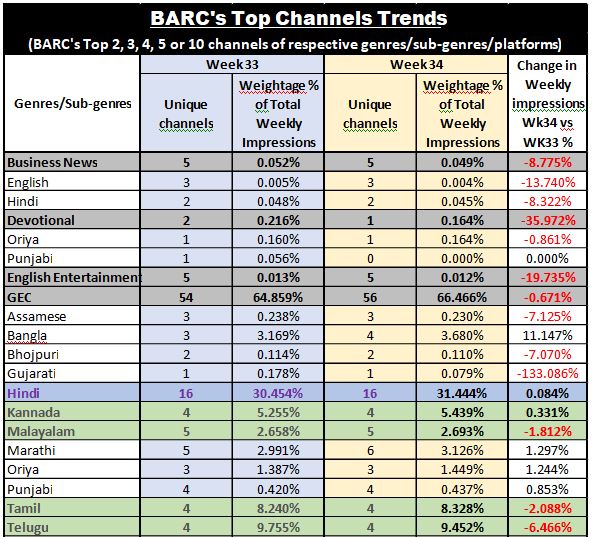

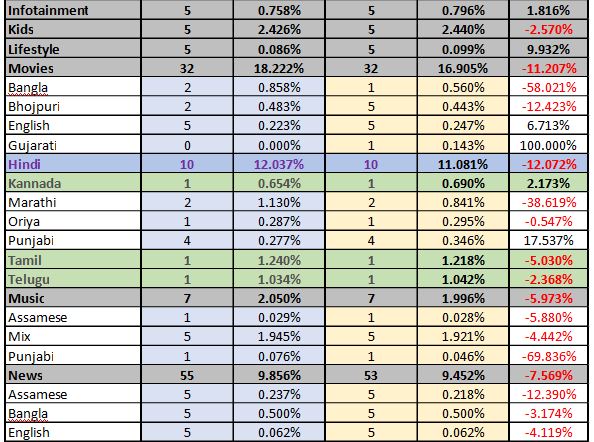

Analysis of BARC data of the top 3, 4, 5 or 10 channels of different genres of GECs’ reveals that despite viewership of the top 56 unique GEC channels from multiple genres declining 0.7 percent in Week 34 of 2020 as compared to 54 unique GEC channels from multiple genres in Week 34, the ratings of top 16 Hindi GECs’ was flat (increased 0.1 percent) as compared to the previous week. The drop in viewership was mainly in the regional languages including South Indian languages GECs’.

Similarly, in the case of News channels, though ratings of 50 plus unique news channels in different language declined by more than 5 percent in Week 34 of 2020 as compared to Week 33, ratings of the Top 5 Hindi News channels during the same period increased by 4.2 percent as compared to 6 unique channels in Week 33 of 2020. Hence, it is the Hindi channels that have reduced the impact of the fall in overall viewership ratings in Week 34 of 2020 from the ratings of Week 33 of 2020.

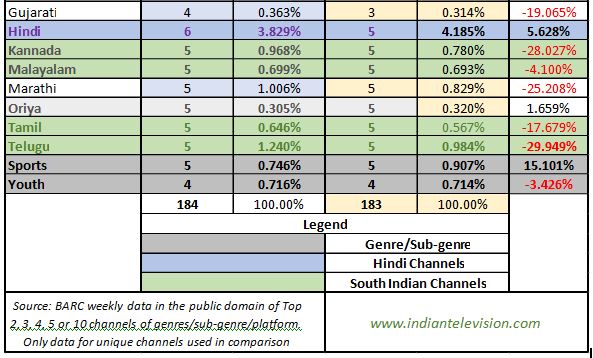

The figure below shows viewership share of various genres. It must be noted that the number of unique channels in both weeks is not the same (184 in Week 33 and 183 in Week 34 of 2020), and hence the number of unique channels across genres/sub-genres/languages/platform in the chart below are not the same in some cases. The author has created a rough measure by using data for unique channels that figure in BARCs’ weekly lists of Top 2, 3, 4, 5 or 10 channels for the two weeks.

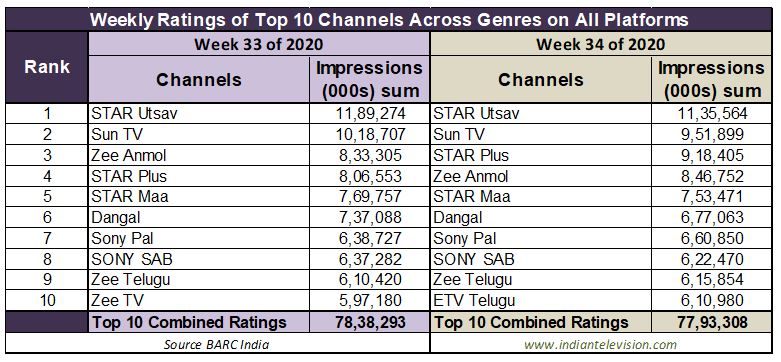

Top 10 Channels on All PlatformsAcross Genres

Star India’s Hindi GEC Star Utsav continued heading BARC’s weekly list of Top 10 Channels on All Platforms Across Genres in Week 34 of 2020 for the third week in a row. As a matter of fact, 9 of the 10 channels in BARC’s Weekly list for Week 34 of 2020 were the same and had almost the same ranks as in the previous week. The only small reshuffling in ranks was the exchange of ranks between Zee Entertainment Enterprises Limited (Zeel) Hindi GEC Zee Anmol and Star India’s flagship Hindi GEC Star Plus. The latter moved up one place while the formed dropped one place to rank4. The other change was that Zeel’s flagship Hindi GEC Zee TV at rank 10 in Week 33 of 2020 exited the list during the period under review and was replaced by the Network18 (Viacom18) associated Telugu channel ETV Telugu.

Six Hindi GECs’, three Telugu channels and one Tamil channel made up BARC’s weekly list of Top 10 Channels on All Platforms Across Genres in Week 30 of 2020. There were 3 Star India channels, two channels each from Sony Pictures Network India (SPN) and Zeel and one channel each from Enterr 10 Television, Sun TV Network (Sun TV) and Network18/Viacom18 in the list for Top 10 Channels on All Platforms Across Genres in Week 34 of 2020.

Please refer to the chart below:

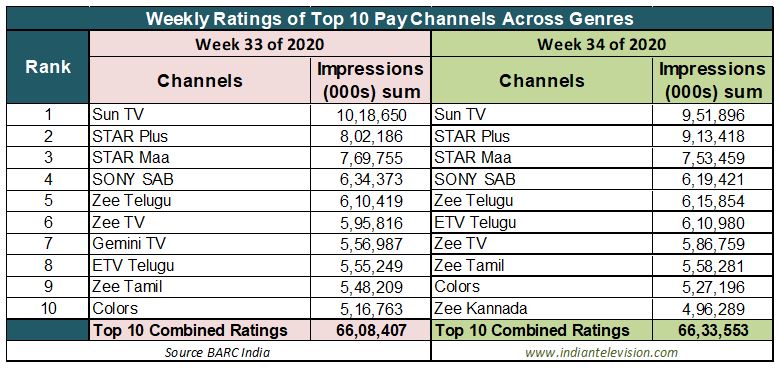

Top 10 Pay Channels Across Genres

Sun TV continued to lead BARC Weekly list of Top 10 Pay Channels Across Genres during the period under review. Nine of the 10 channels in BARC’s weekly list for Week 34 of 2020 were the same as in the previous week, but with some shuffling of ranks. Gemini TV, The Sun TV Network’s flagship Telugu GEC, exited the list and was replaced by Zeel’s flagship Kannada GEC Zee Kannada.

There were four channels from the Hindi GEC genre, three channels from the Telugu genre two channels from the Tamil genre and one channel Kannada genre in BARC weekly list of Top 10 Pay Channels Across Genres in Week 34 of 2020. There were three channels from Zeel, two channels each from Star India, Sun Tv Network and Network18/Viacom18 and one channel from SPN in BARC’s weekly top paychannels list for Week 34 of 2020. Please refer to the chart below.

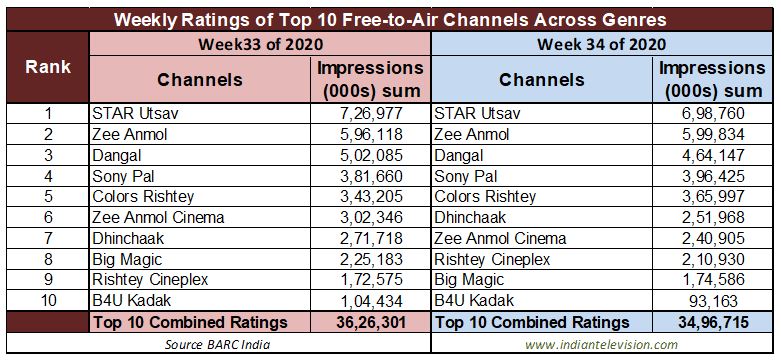

Top 10 Free Channels Across Genres

Star Utsav headed BARC’s weekly list of Top 10 Free Channels Across Genres in Week 34 of 2020. All of the 10 channels in BARC’s weekly list of Top 10 Free Channels Across Genres in Week 30 of 2020 were the same as in Week 29 with some shuffling of ranks

There were three channels from Zeel, two channels from Viacom18 and one channel each from B4U Network, Enterr 10 Television, Goldmine Telefilms, SPN and Star India in BARC’s weekly list of Top 10 Free Channels Across Genres in Week 30 of 2020. There six Hindi GECs’ and four Hindi Movies channels in BARC’s weekly list of Top 10 Free Channels Across Genres in Week 29 of 2020. Please refer to the figure below: