Strapline: Live sports viewing has always been and continues to be a TV phenomenon globally. The clear viewer preference for watching sports on television with friends and family is reflected in the scale of IPL viewership on TV. Digital on the other hand largely comprises in-transit viewing on smartphones, while CTV streaming is still at a nascent stage.

IPL viewing in India, much like other live sports events, has been dominated by television. Come summer, little or nothing might change despite all the hype around free access to content and devices like the Jio Media Cable. While estimations on digital viewership for IPL 2023 have been ambitious, the on-ground reality of its scalability is far from meeting the expectations.

Barriers for scaling IPL on Digital:

Digital streaming universe restricted to the smartphone base in India: Multiple credible industry reports of EY-FICCI and Affle have confirmed that the smartphone penetration in India is close to 460 million, half of television penetration in India. The digital video universe in India which can be defined by YouTube’s active install-base as of January 2023 is 445 million. In addition, CTV accounts for 20-30 million viewers. The only way IPL streaming on digital could reach the ambitious scale estimated in reports, is if 100 per cent smartphones and CTV audiences are tuned in to IPL, which is practically impossible.

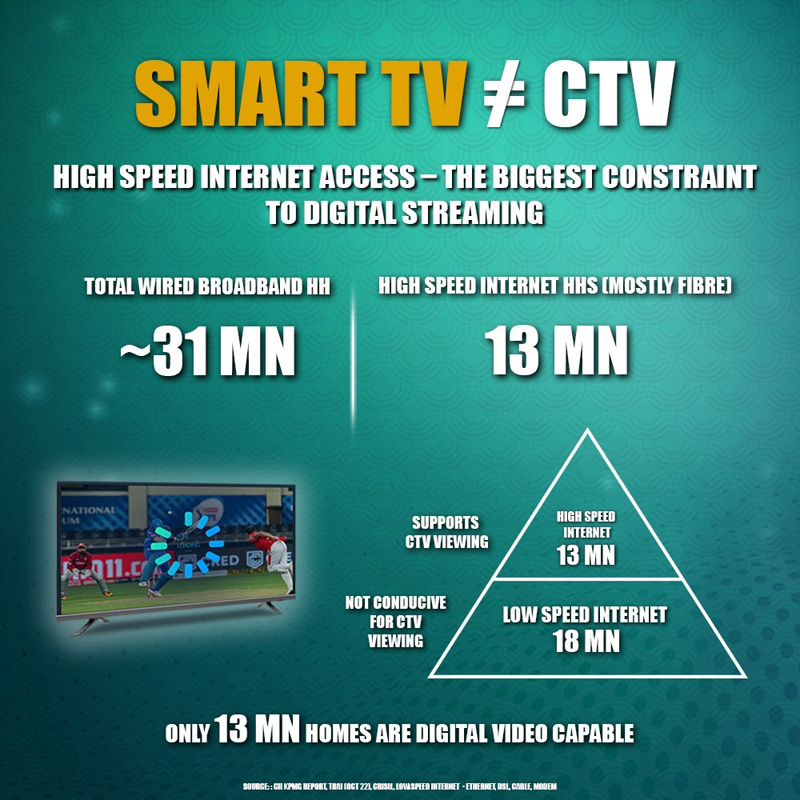

CTV base in India too small to drive scale

CTV is a mere incremental addition to digital’s scale with a universe of 10 million homes as confirmed by reports from EY-FICCI as well as CII-KPMG in 2022. While the smart TV universe may be higher, only about 10 million households are equipped with high-speed connectivity as per TRAI, which is essential for a smart TV to be a connected TV. In comparison, HD homes have recently grown to 70 million homes in India, comprising 200 million audiences, a scale 7x of CTV in India.

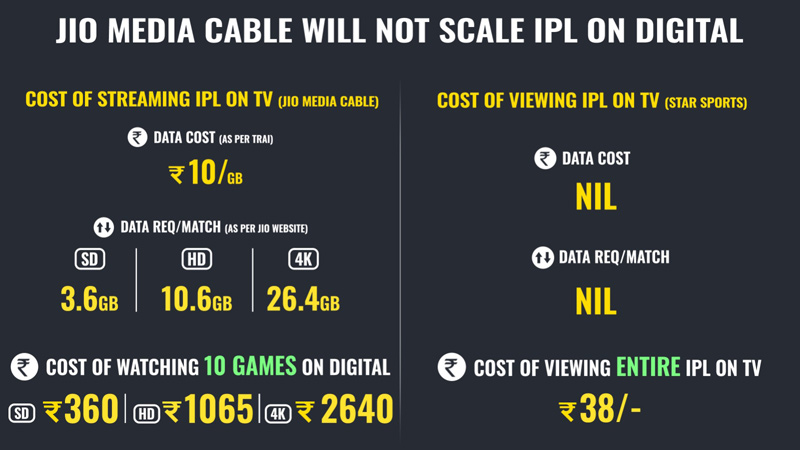

High Data Cost for Jio Media Cable to deter scale

Even the Jio Media Cable which would let people connect their phone to a TV to turn it into a smart TV is a proposition that comes with a fundamental issue that will prevent it from scaling. Typically, with a 3.5-hour match duration, the data required to stream a match using the Jio Media Cable ranges from 3.6 GB/match for SD transmission to 26+ GB/match for 4K transmission. Considering the cost per GB as determined by TRAI is about Rs 10, the cost of streaming merely 10 IPL games with the Jio Media Cable would be in a range of Rs 360 - Rs 2640. The Jio cable will not be able to drive scale considering that anyone could watch even the HD feed of IPL on television at a paltry cost of Rs.19 per month. Therefore, the data cost for watching just 10 games will be 10x higher than watching the entire IPL on TV.

Free Access doesn’t convert into viewership

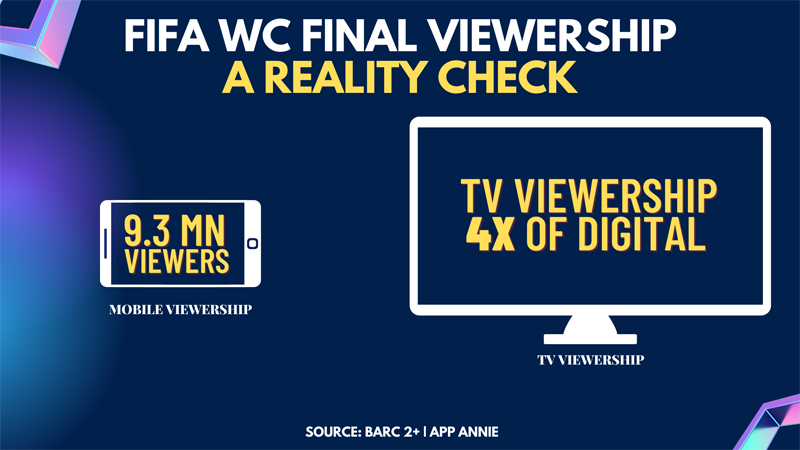

Free of cost access to live sports content is not a novel concept in India, and it certainly hasn’t influenced a conversion to viewership at scale. IPL 2019 was free of cost for Jio users and while close to 315 million smartphone users had a Jio sim, the reach it drove was merely 100 million in the season. The T20 World Cup in 2022 was broadcasted free on DD and only 48 million viewers of the 207 million DD universe (23 per cent) actually contributed to the viewership of the tournament. More recently, data from app analytics company App Annie revealed that only 9.3 million users watched the FIFA World Cup Final free of cost on smartphones. To add to that, the TV reach for the FIFA World Cup final as per BARC was 34 million viewers, 4x of mobile viewership. Even after accounting for CTV viewers, the claimed digital viewership of 32 million for the FIFA World Cup Final seems too far-fetched. Pay TV viewership superseded digital viewership and continued its domination as platform of preference for live sports viewers in India, showcasing barely incremental contribution from free live sports content.

Why TV will continue to dominate IPL viewership

The power of TV for live sports consumption will continue to be the biggest deterrent for digital streaming on IPL. The TV penetration of 900 million viewers and HD penetration of 70 million homes are unmatched in comparison to mobile and CTV in India. TV dominates an exclusive audience of over 400 million viewers against the combined total of smartphones and CTVs in India. The lag that occurs during digital streaming has been and will continue to be the biggest deterrent for live sports viewers. TV delivers a lag-free experience with significantly better audio-visual quality, making the platform the clear preference for live sports consumption in India. Considering the growth of Pay TV and HD homes in India, television is well poised to reach a scale of 500 million viewers this IPL 2023.