Mumbai: The digital streaming universe in India is restricted largely to the smartphone base of ~460 million users in India, curbing the scale of IPL on digital severely compared to television which reaches out to 900mn viewers. Even within the smartphone universe in India, there remains a massive constraint in the consumption of sports due to consumer preference for watching live sports on TV, the increasing number of pay TV homes and high data costs of streaming compared to the ease of availability of same live sports content at negligible cost on TV.

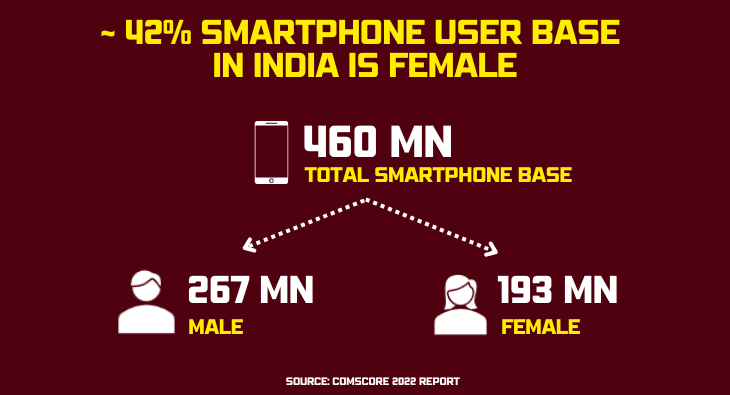

Another critical factor restricting the scale of IPL viewership on digital is the high share of female ownership of smartphones.

Almost half of the smartphone universe in India comprises female audiences: As per a recent Comscore report, ~193 million out of the 460 million smartphone owners are females. Historically, digital streaming of sports has largely been a male domain with close to 85 per cent contribution to overall IPL digital viewers. Digital streaming of IPL is largely solo-viewing and women have very low interest in solo-view sports content. They prefer to watch with family and friends on TV. This, along with their negligible intent to download an app for sports content is expected to severely impact the overall digital reach of IPL to 160-180mn on mobiles.

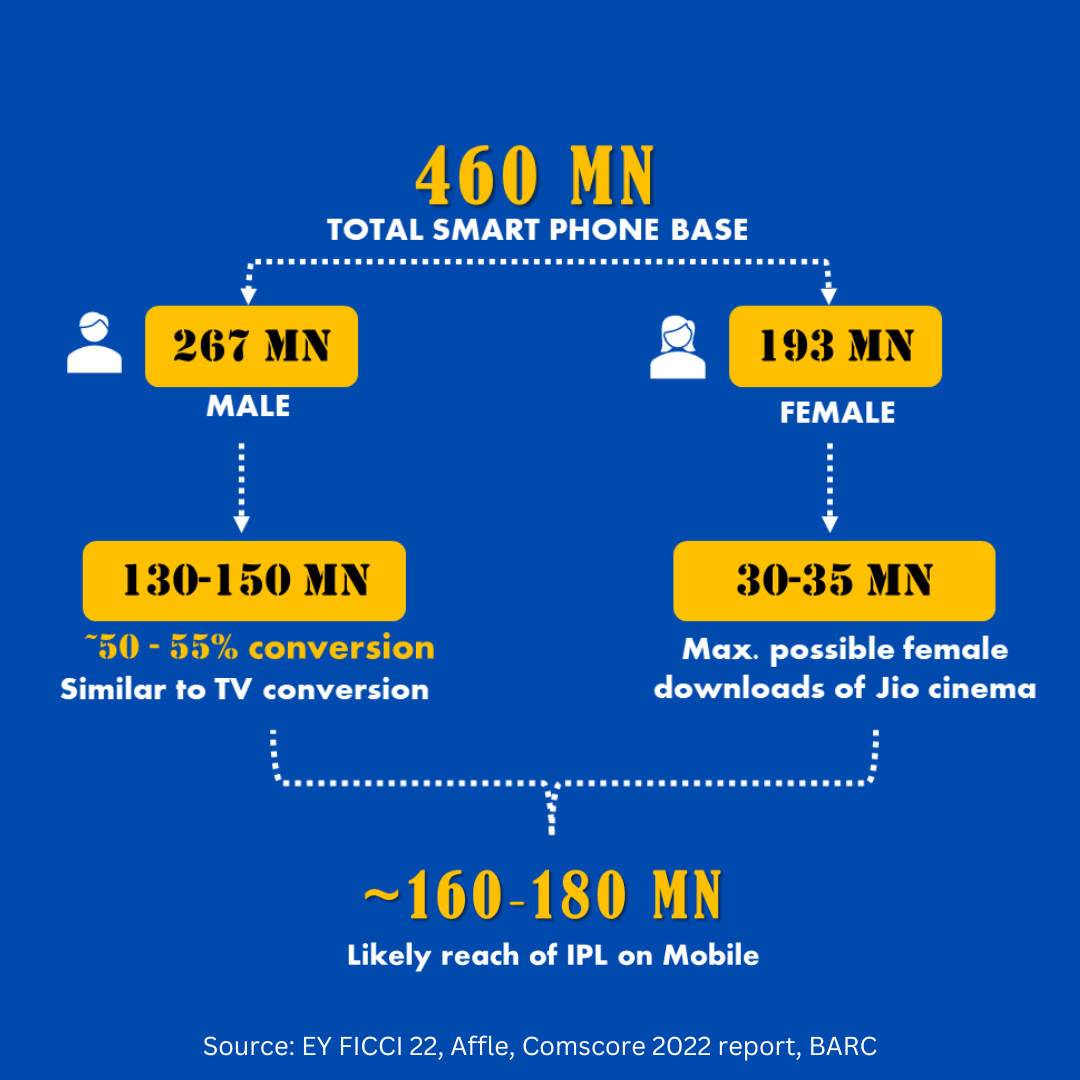

Intent to download and solo-view sports content is very low among women: Cricket viewing among female audiences has been only a small fraction of the overall viewership of the sport in India. In 2019, when IPL was free, a mere 20 million women watched the tournament on digital. The intent to download an app and solo-view IPL is extremely low and most women prefer watching IPL on television, when friends and families come together to enjoy a collective viewing experience. The number of female users of top fantasy and cricket news related apps is barely 4-6 million, showcasing very low affinity for sport. Even for an entertainment app like MX player, the downloads are restricted to just 34 million among females as per App Annie data. This suggests that the potential downloads among female audiences could be anywhere between 30-35 million, a number too small to help scale IPL streaming on digital.

Miniscule smartphone base to restrict IPL digital reach to less than 200 million: Considering that the potential downloads among female users is expected to remain in the range of 30-35 million, how much could the male addressable base contribute to make IPL scalable on digital? Currently the composition of the male smartphone universe is close to 267 million as per Comscore. The conversion rate of male smartphone users to IPL streamers on digital can be estimated by looking at the conversion rate on TV which is in the range of 50-55 per cent. The likely male audiences for IPL on digital as a result could be in the region of ~130-150 million. On combining male and female audiences on digital, 160-180 million is the likely reach IPL can deliver this year on digital. Even after accounting for CTV reach, the overall digital IPL reach will be less than 200mn.

Television is the natural medium for viewing sports content as it allows viewers to celebrate the game and its memorable moments together with friends and family. TV delivers a lag-free experience with significantly better audio-visual quality, making the platform the clear preference for live sports consumption in India. The massive scale that IPL on television garners is more than 2X of what digital can achieve in the coming season of IPL, giving advertisers a clear view on why IPL on TV will continue to be the driver of scale and impact. Considering the growth of Pay TV and HD homes in India, television is well poised to reach a scale of 500 million viewers this IPL 2023.