While creating this write up on something that’s as wide and far as India OTT we decided to be as objective as possible and use data to establish and talk about some key trends that we see both unique as well as interesting on how the sector is evolving.

App Annie is a third-party app analytics tool that provides the starting point to map the market within the limitation of the methodology that they use. While it cannot be a gospel of truth, its a good indication of trends. Hope you find this useful high-level dynamics.

Some caveats and assumptions that we have made:

• Data is App Annie for Jan-Dec 2018 and Jan-Oct 2019 extrapolated for Jan-Dec 2019

• SVOD classification: including Telco, International and few independent apps

• AVOD/Freemium classification: including Broadcast and other independent apps

1. How does the India OTT market compare with some of the countries emerging OTT markets?

• In terms of the # of OTT players India continues to be the most competitive in the world.

• In India, while a few players seem to have stopped reported by App Annie they have been replaced by another set of new players keeping the total number of players to 33 as reported the same vis-a-vis 2018

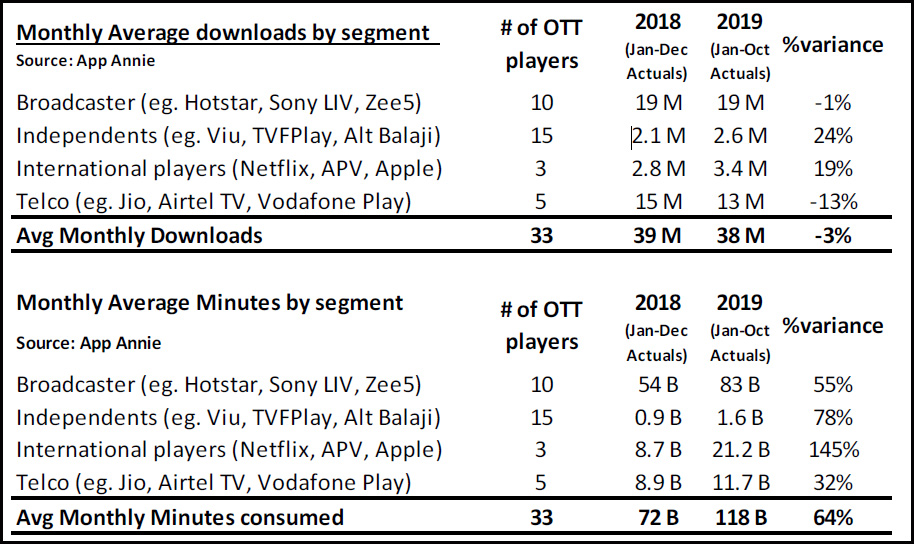

• The India market continues to be represented uniquely by all 4 segments of players - Broadcasters who have risen well to the challenge, International players with deep pockets like Netfilx, APV and Apple TV, the telcos and finally a large number of independents like VIU, Balaji Alt, Eros Now, HoiChoi.

• Other territories are less competitive (or benign?) vs India OTT with the International players dominating in most markets. With exception of the MENA region, hardly any broadcasters participating as vigorously as in India

• Crystal Ball Gazing: It will be interesting to see how much consolidation accelerates in 2020 with Disney Plus and more activity from the defenders?

2. How has the India OTT market progressed vs 2018 on downloads and on consumption?

• The number of downloads has remained flat vs 2018 but the Minutes Consumed increased by 64%. Is there some sign of maturity and loyalty setting into the behaviour of the consumer now?

• Indians are consuming on an average 118 billion minutes per month consuming on OTT apps in the country. Clearly that’s coming at the cost of more traditional video sources.

• We don’t think OTT will kill TV but the challenge is now very real and visible. Is potential finally turning to reality?

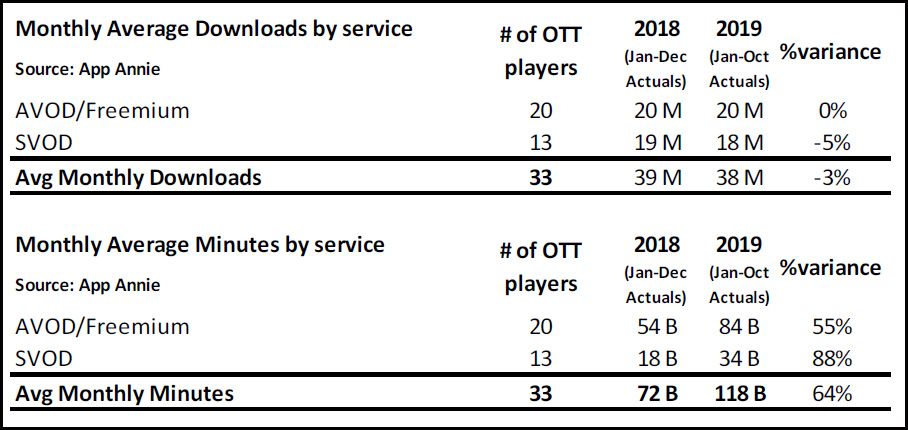

3. The most polarising part of the OTT business. What is the interplay between the SVOD and the AVOD services?

• Downloads growth is flat between the two segments. On Minutes growth, the SVOD services seem to have made gains although they still lag the AVOD / Freemium in terms of absolutes.

• Clearly the paying or free trial customer is making full use of the SVOD access. Depth of content, highly visible shows in terms of promotions by the SVOD players like Netflix and APV seem to be winning customers.

App Annie data also indicates how skewed the market is towards the top cluster. In terms of minutes share, 90% of the total minutes is contributed by 6 apps with the remaining 27 players giving 10% of minutes share. These top OTT apps by minutes share are:

While 2018 was a year of making a splash with never before seen production mounting on the OTT space, heavy marketing spends to support these launches 2019 did come across to be a year of and consolidating. Focus on revenue and recovery of investments (real profitability is still some time away) was high.

Some bets on 2020:

• Original content launches will be the flavour of the season with all the effort and our suspicion is that the hours of content here will rival that of a GEC channel producing and releasing first run content.

• Regional will continue to grow. More regional OTT launches – be it from broadcasters or from International players will be seen and there will also be a few independents like in the case of Telugu launching services.

• The “for whom” will assume a stronger accent on content productions. More TG focused web originals will emerge instead of GEC style of content catering to a wider base

• Technology driven by personalization, AI powered discoverability to unearth content specific to viewers will take on a deeper play.

• SVOD players will innovate on pricing or payment mechanisms to deepen penetration, AVOD players will push for innovation on monetization beyond inventory to realise their reach potential

2020 promises to be a tough year for the players but an exciting one for consumers who will continue to be spoilt for choice.

(Vishal Maheshwari is country manager, and DS Ramakant Raju is associate director, growth marketing at Viu India. The views expressed are their own and Indiantelevision.com may not subscribe to them.)