Mumbai: Any talk of content in a post-pandemic world is incomplete without deliberating on the impact it has had on the OTT industry and vice versa.

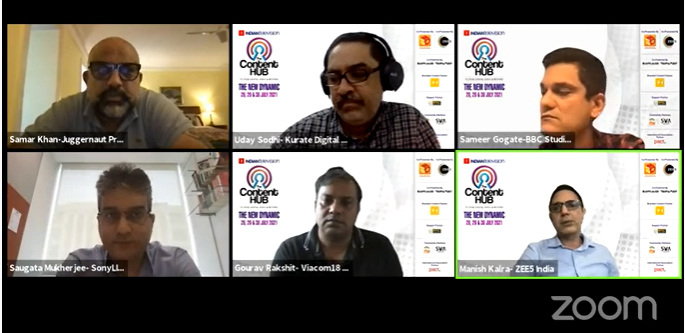

The fifth edition of the ‘Content Hub 2021 - TV, Film, Digital Video, and Beyond’ organised by Indiantelevision.com brought together the heads of three of the country’s leading OTT platforms - Viacom 18 Digital Ventures, COO - Gourav Rakshit, ZEE5 India, chief business officer - Manish Kalra, and SonyLIV, head of originals - Saugata Mukherjee - and renowned content producers - BBC Studios India’s general manager (production), Sameer Gogate and Juggernaut Productions’ COO (OTT), Samar Khan, to throw light on the evolving phenomenon. Kurate Digital Consulting, founding partner, Uday Sodhi moderated the discussion.

The impact of the pandemic on the OTT industry is not lost on anyone. As the lockdown-induced demand for new content skyrocketed, people were motivated to sample OTT platforms. As a result, the evolution of consumers in terms of OTT adoption which would have otherwise taken at least a couple of years to happen, transpired within the course of a few months.

The more noteworthy aspect of it, however, was that people were now willing to pay for content. According to industry experts, this marked a huge milestone as far as consumer behaviour is concerned, more so in the Indian market which was hitherto believed to be largely AVOD-driven for OTT players.

Viacom’s Gourav Rakshit called it the second “tipping moment” for the industry, next only to cheap data. The development was extremely positive, but it came along with a big challenge of retaining consumers by providing them new, relevant and engaging content, which meant bringing quick and drastic changes in content strategies. The growth in consumer appetite for content was thus accompanied by a proportional rise in the risk-taking ability of OTT players.

“If we didn’t genuinely think that everyone is just a mouse-click away from joining OTT, we would have never put a property like Bigg Boss on digital alone,” asserted Rakshit.

“Despite the production troubles and scarcity of right content, the demand gave us the confidence to take big bets. For the first time we decided to bring a blockbuster like Radhe on TVOD. Although we were quite sceptical of TVOD as a model and about Indians paying for a one-time rental, the results were pleasantly surprising. 30 per cent of our Radhe consumption happened on TVOD. In the process, we kind of ‘forcefully’ moved our content strategy to movies and regional,” added Kalra.

SonyLIV’s Saugata Mukherjee agreed that the pandemic was a huge learning curve for the industry, and the changes (VOD consumption, consumer willingness to pay, OTT movies, and long-format shows) affected by it are here to stay. “Starting out with half-a-million subscribers on 18 June, today we have crossed six million. The pandemic has really expedited OTT adoption, and we have managed to keep pace with it by dropping new shows every month despite the difficult production scenario. There have been a few good shows like ‘Maharani’ and we also had ‘Scam’ walking away with all the glory. Both were well received across segments, signifying that the right kind of story will have takers everywhere.”

With the requirement of content growing every day, content producers found themselves in a tough position having to deal with the challenge of coming up with fresh story ideas at a mind boggling rate. “So many stories were being told that it became quite challenging for us to find the next big idea. Moreover, with every success the bar kept getting higher,” stated Juggernaut Productions’ Samar Khan.

Gogate of BBC Studios shared a slightly different perspective. “While I don’t think there is scarcity of ideas and talent, the way we tell stories needs constant reinventing. This effectively means that the ‘premiumness’ of content in terms of writing and making, not the cost, has to get better. The second big challenge is to keep resetting the mix in accordance with the predicted demand scenario for at least six months hence. The game has become far more dynamic than what it used to be,” added Gogate.

Talking about how the content mix on their respective platforms is changing, Kalra’s shares an interesting finding from ZEE5’s research which reveals that viewers look at OTT as a ‘buffet’. “What people watch at any given point of time is a function of their mood, and hence it is important for us to cater to all taste clusters,” he said.

As regards the ‘buffet menu’, the panelists agreed that there is currently an overdose of ‘high-concept’ and crime shows on OTT platforms making them slightly metro and male-skewed. There’s not enough content to service the staggering demand for tentpole premium dramas suited for family viewing. Both Gogate and Khan shared the opinion that comedy, being a difficult genre, is most underserviced at present.

Crystal gazing at the next 18 months, Kalra remarked that, “already 65 per cent of our consumption is happening on connected TV, so most of the demand is going to come from the family-viewing space. Big-screen viewing, tier two and three audiences, and regional content will be on the rise.” As believers in the potential of regional content, Rakshit and Mukherjee also agreed that the authentic and relevant stories and characters that they are looking for will come from the tier two and three, regional markets.

“Regional scripted as a genre hasn’t taken off yet, but there is a lot of work happening on it. It could well be the next frontier in the coming six to eight months. Regional markets have a lot of talent and stories, but they are essentially individual-driven. If we can get the discipline of the big companies to percolate into these markets through collaborations, things will change overnight,” said Gogate.

Coming to the big question around the comparative demand for series and films and whether OTT theatricals can become a phenomenon, trends so far have shown that the demand for series is far higher. However, with an exception of Samar Khan who believes that the direct-to-digital release wave was a function of theatres remaining closed and a significant chunk of the audience will go back to them when the situation normalises, others on the panel were more hopeful about it.

Contending that “movie-making and film distribution will not be the same again”, SonyLIV’s Mukherjee noted, “While theatres will always be around, there’s going to be some demarcation as far as the medium is concerned. A lot of scripts which didn’t find a theatre or platform to showcase will possibly come to OTT. This, in itself, is a big market opening up. Theatrical experience will become somewhat limited to the slightly bigger spectacle movies, with the more midlist category films looking for a direct-to-digital release.”

Mukherjee and Gogate also held that being quite a young industry, the ‘OTT movie making’ grammar is still evolving, as is the grammar around making eight-hour long form series. The answers to these questions will emerge as and when more and more content starts getting made specifically and exclusively for the OTT platforms.

Adding to the conversation, Kalra shared that Zee5 witnessed considerable demand for regional theatricals coming from the tier two and three markets. “Although theatres shutting down had the greatest impact, producers have surely developed an appetite for risk-taking. What remains to be seen is whether the phenomenon will continue as ‘direct-to-digital’ or ‘delayed-from-theatrical’. That is something we will learn in the process.”

Last but not the least, talking of government regulation the panelists maintained that it hasn’t disrupted life and work for them in any significant manner yet. The impact will become clear only when the first 10-15 cases arise. That being said, Rakshit opined that “one of the positive rub-offs of it is that dissent gets centralised and doesn’t run into unnecessary PILs and courts all over the country which is just negative for the industry. On that note, it’s actually quite welcome.”

The fifth edition of Content Hub 2021- ‘TV, Film, Digital Video, and Beyond’ was co-presented by IN10 Media Network and ZEE5, and co-powered by Applause Entertainment and Tipping Point, the digital content unit of Viacom18 Studios. PTC Network is the supporting partner.