Mumbai: Consumer sentiment among urban Indians has improved and has shown recovery in September 2024 with a minor uptick of plus 0.4 percentage points. Further, the consumer sentiment is up for jobs, economy, investments and personal finances, according to the September wave of the LSEG-Ipsos primary consumer sentiment index (PCSI) India report.

The LSEG-Ipsos PCSI maps consumer sentiment on four sub-indices and the sentiment for the PCSI employment onfidence (“Jobs”) sub-index, has seen an uptick of plus 1.1 percentage points, the PCSI urrent personal financial conditions sub index (current conditions) is up plus 0.3 percentage points; the PCSI investment climate (“Investment”) sub-index is up plus 0.1 percentage points; and the PCSI Economic Expectations (“expectations”) sub-index is up plus 0.5 percentage points.

Also, India has ranked second on national index score across 29 markets.

Ipsos India CEO Amit Adarkar has high hopes on H2, after a tough H1: "Consumer sentiment has shown recovery after being downbeat last month. Apart from the overall upswing in consumer confidence this month, the sentiment has shown recovery for daily household spends, savings, economic growth and jobs. H1 saw major cutback by companies due to tough macro conditions and the global economic slowdown, global inflationary conditions and job cuts. With a good monsoon this year and the festival season reaching its pinnacle with navratri, dhanteras and diwali coming up, consumer sentiment should see a major boost next month. Sentiment around jobs improved last month, and this month too consumers are bullish about the job market and hiring. India is also recovering from the havoc unleashed by extreme weather conditions, in terms of flooding and landslides through July and August."

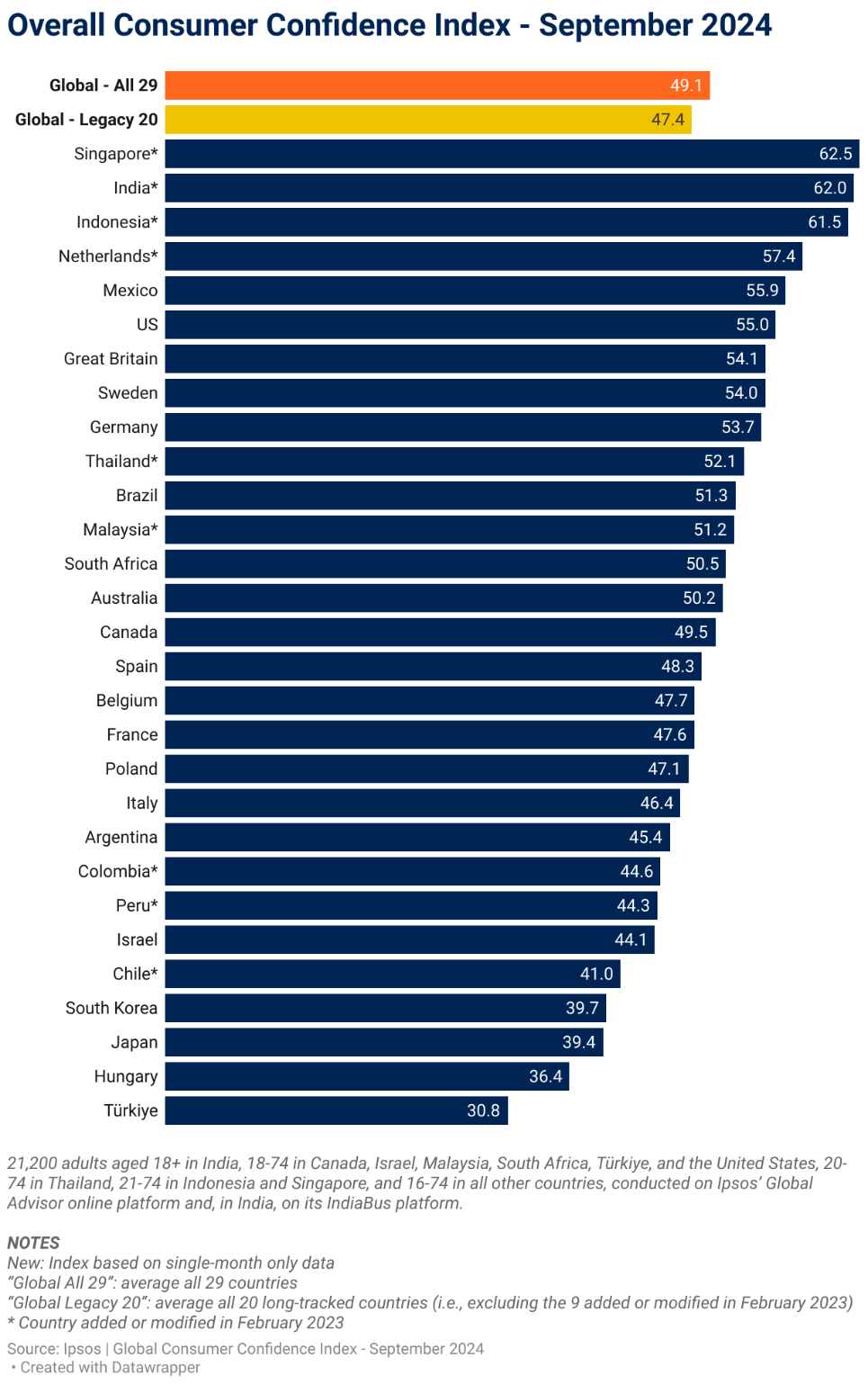

Consumer sentiment in 29 countries

Among the 29 countries, Singapore (62.5) now holds the highest national index score. Singapore, along with India (62.0) and Indonesia (61.5) are the only countries with a national index score of 60 or higher.

Eleven other countries now show a National Index above the 50-point mark: the Netherlands (57.4), Mexico (55.9), the U.S. (55.0), Great Britain (54.1), Sweden (54.0), Germany (53.7), Thailand (52.1), Brazil (51.3), Malaysia (51.2), South Africa (50.5), and Australia (50.2).

In contrast, just four countries show a National Index below the 40-point mark: South Korea (39.7), Japan (39.4), Hungary (36.4), and Türkiye (30.8).

“Notably, India has stayed among the top three markets with high national index score and stayed resilient despite several global crises popping up one after the other. Being a growth oriented emerging market and its economy resting greatly on domestic consumption, we have been able to offset the extreme impact. Though global economic slowdown has further weakened the rupee against the dollar,” stated Adarkar.