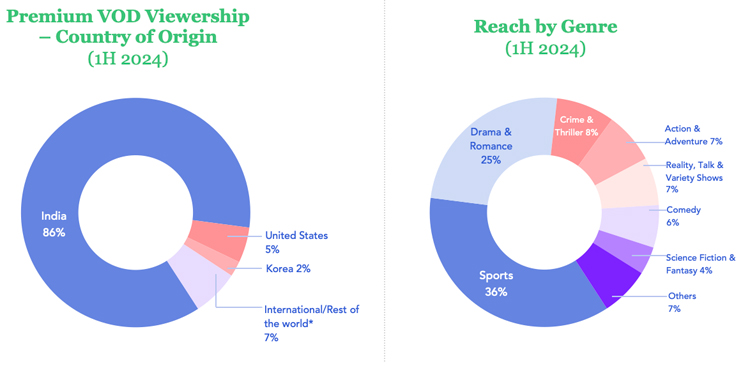

Mumbai: The premium video-on-demand (VOD) category, driven by advertising and subscription, generated $1.04 billion in revenues over 1H 2024, up 38 per cent from $760 million in 1H 2023. Local content accounted for 86 per cent of premium VOD engagement in 1H 2024, with live sports and local drama & romance leading category demand. Sports content attracted the highest number of unique viewers, with nine of the top 15 titles belonging to the sports genre - six of which were BCCI events. Cricket was the standout, as IPL 2024 and the ICC Men's T20 World Cup 2024 were the top two sports properties, driving significant viewership.

The take-outs were revealed by the latest analysis conducted by ampd, the digital measurement platform owned and operated by Media Partners Asia (MPA), which measures consumption and engagement across the digital economy in India, including VOD. In 1H 2024, a total of 8 trillion minutes were streamed across online video platforms in India. YouTube dominated the landscape, capturing 92 per cent of all online video consumption, while premium platforms—comprising AVOD, freemium, and SVOD services—accounted for the remaining eight per cent. Within the premium video segment, freemium platforms led with 92 per cent of the 645 bil minutes streamed during the same period.

Jio Cinema, Netflix, and Disney+ Hotstar led premium VOD category monetisation, contributing 70 per cent of the total revenues garnered by the category. Jio Cinema was the category leader in 1H 2024 with 36 per cent revenue share while Netflix led pure-play SVOD monetization with a 38 per cent share.

Premium VOD ad revenue in 1H 2024 was driven by Jio Cinema and Disney+ Hotstar, leveraging marquee cricket with the Indian Premiere League (IPL) and ICC World Cup. After a turbulent CY2023, total SVOD subscriptions rebounded from 110 million to 120 million in 1H 2024. India’s TAM of affluent audiences continues to expand, with Netflix and Prime Video capitalising on this trend through investments in local originals and films. Together, these platforms accounted for nearly 70 per cent of SVOD revenue in 1H 2024. Meanwhile, Jio Cinema’s launch of an affordable plan has further broadened the SVOD audience, incentivising more users to pay for streaming content.

Commenting on the findings, MPA India vice president Mihir Shah said, “Subscriber growth momentum will continue in 2H 2024, driven by aggregation and deeper partnerships with telcos, pay-TV operators, and OEMs. In addition, with the onset of the festive season at, advertising spending should be robust in Q4 2024. However, with no major sports events, spending will shift toward tentpole non-fiction shows on premium VOD platforms, with a significant portion moving back to high-reach UGC platforms. Netflix and Prime Video have a steady stream of content planned for 2H 2024. For freemium platforms, entertainment spends have started to come back under new advertising-friendly formats like TV++, which are similar to daily TV soap operas with 40-120 plus episodes per season. These formats have proven to attract new users and drive engagement with lower budgets.”