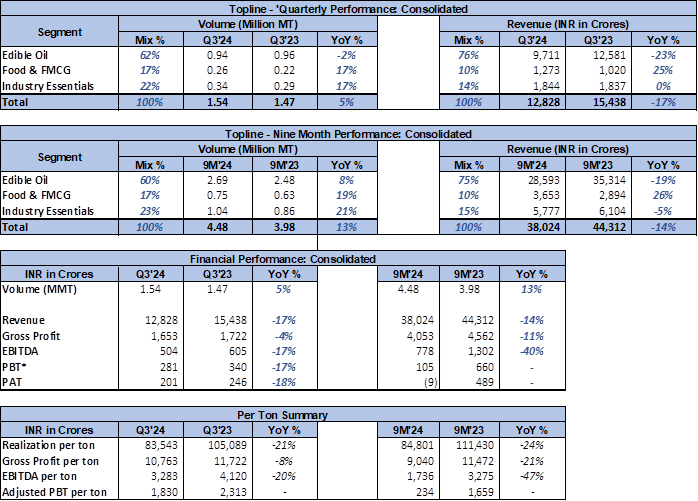

Mumbai: Adani Wilmar Limited (AWL) records a strong 13 per cent volume growth in 9M FY24, with broad based growth across all segments. Sequential revenue growth of 5 per cent QoQ (Q3’24 vs. Q2’24). In 9M ’24, the food & FMCG segment recorded a revenue of Rs 3653 crore, a 26 per cent YoY growth company achieved best EBITDA till date, at Rs 504 crore in Q3.

The company’s growth trajectory remained steady with a volume growth of 5 per cent YoY in Q3’24 and 13 per cent YoY in 9M FY’24. Consumer demand in packaged staple foods stayed strong during the festive season of Q3. The branded products that comprises 80 per cent of edible oils and Foods & FMCG sales, grew faster than the overall sales in both segments. Rural sales also stayed steady for us. Despite good volume growth, revenue is optically lower by 17 per cent YoY in Q3, as product pricing has been lower during the year, in-line with lower raw-material costs.

The company recorded revenue of Rs 12828 crore in Q3 and Rs 38024 crores in 9M FY’24. The profitability of the company has again normalised with EBITDA at Rs 504 crore. In Q3, after witnessing 2 quarters of subdued profits due to high-cost inventory and hedge dis-alignment. Profitability of the Bangladesh subsidiary continues to be in stress due to the local currency issues. Standalone EBITDA was higher at Rs 530 crore in Q3.

The company is progressively using more regional approaches to drive deeper penetration into the local markets. The company is on track to more than double its rural town coverage during the financial year from 13,000 towns to more than 30,000 rural towns by the end of this financial year. The company has been adding new markets and our branded products are now available in 38 countries across six continents.

Edible oil

The volume was flat YoY in Q3 and grew by 8 per cent YoY during 9M FY’24. Branded products have been growing at a faster pace. Branded products grew by 3 per cent YoY in Q3 and 15 per cent YoY in 9M FY’24. ROCP (refined oil consumer pack) market share of AWL in edible oils reached 19.8 per cent in Dec ‘23 on MAT basis (source: Nielsen), which is an improvement of 30 bps vis-à-vis the same period last year.

The segment recorded revenue of Rs 9711 crores in Q3, with sequential growth of 7 per cent compared to Q2. In YoY terms, revenue is optically lower by 23 per cent YoY in Q3 ‘24, as product pricing has been lower during the year, in line with lower raw-material costs.

The growth in the edible oils segment continues to be driven by strong growth in sunflower oil and mustard oil, which have been growing faster than the industry due to strong brand equity.

Food & FMCG

The Food & FMCG segment, which includes products such as wheat flour, rice, pulses, besan, sugar, poha and soap continued to outperform. During the quarter, the segment revenues grew at 25 per cent YoY, with an underlying volume growth of 17 per cent YoY.In 9M FY’24, the segment delivered a turnover of Rs 3653 Crores, a robust growth of 26 per cent YoY.

Exports restriction has been a drag on foods growth in the last three quarters. In the domestic market, branded products revenue has been growing at 40 per cent plus YoY for the last nine quarters.

Wheat business gained share in South India from multiple interventions. This led to a significant improvement in volume off take in Q3, increased penetration in retail outlets, and created pull demand from retailers. In South India, branded penetration is high for the industry, along with good pricing power for brands. We will continue to focus on the South India market to gain our fair share.

Industry essentials

The industry essentials volume grew by 17 per cent YoY in Q3 '24 and 21 per cent YoY in 9M FY’24, supported by robust growth in Castor & Oleochemical businesses. The segment recorded revenue of Rs 1844 in Q3 and Rs 5777 in 9M FY’24.

Key highlights -

1 Volumes show strong resilience and reflect robust consumer demand, growing at 5 per cent YoY in Q3 and 14 per cent YoY for 9M FY24 across all segments.

2 Branded products, which are 80 per cent of sales of edible oils, Foods & FMCG, show higher growth.

3 Branded Food & FMCG in the domestic market has shown market-beating growth of over 40 per cent YoY in the past 9 quarters with the segment expected to touch a milestone revenue of Rs 5000 crores for FY ‘24.

4 Rural demand is stable, belying expectations of weak rural demand having a major impact on consumer goods sales.

5 Company on track to more than double rural coverage from 13000 to over 30000 rural towns by the end of FY24.

6 Revenue dip reflects lower prices of edible oils in response to decline in input costs of raw materials. However, strong brand equity drives growth in sunflower oil and mustard oil faster than the industry.

Commenting on the results Adani Wilmar Limited MD & CEO, Angshu Mallick said: “We continued to witness the growth momentum in packaged staple foods driven by shift in consumer preferences for hygienic and quality products. The revenues from the branded products in the domestic market, under the Food & FMCG segment have been growing at 40 per cent plus YoY in the past 9 quarters enabling us to close FY '24 with an estimated Rs 5,000 crores of revenue in the segment.

We are putting our energies in rapidly scaling up our distribution network for general trade to realise the immense opportunity available in the packaged staple foods. At the same time, we are developing our HORECA and exports channels which will continue to witness much faster growth in the near future. Our strong market share in the alternate channels put us in an advantaged position from the fast-growing rate of this channel.”