Mumbai: The cost of streaming IPL on Digital across SD, HD or 4K ranges between 70x-500x of the TV subscription cost of only Rs 38 for two months. High data cost to limit the reach of IPL on Digital.

The concept of free digital streaming of IPL in India faces a harsh reality that will disincentivize the majority of viewers it was aimed to benefit. An essential underlying cost component that has been ignored is the cost of internet data that it takes to stream a live cricket match. In addition, when you compare that with the reality of the average monthly data consumption in India, two things stand out- firstly, there is a significant hidden cost that viewers will have to incur to stream IPL free on digital. Secondly, the cost of watching IPL on TV with the kind of penetration television has established makes it a clear favorite.

Data Cost – The Hidden Truth

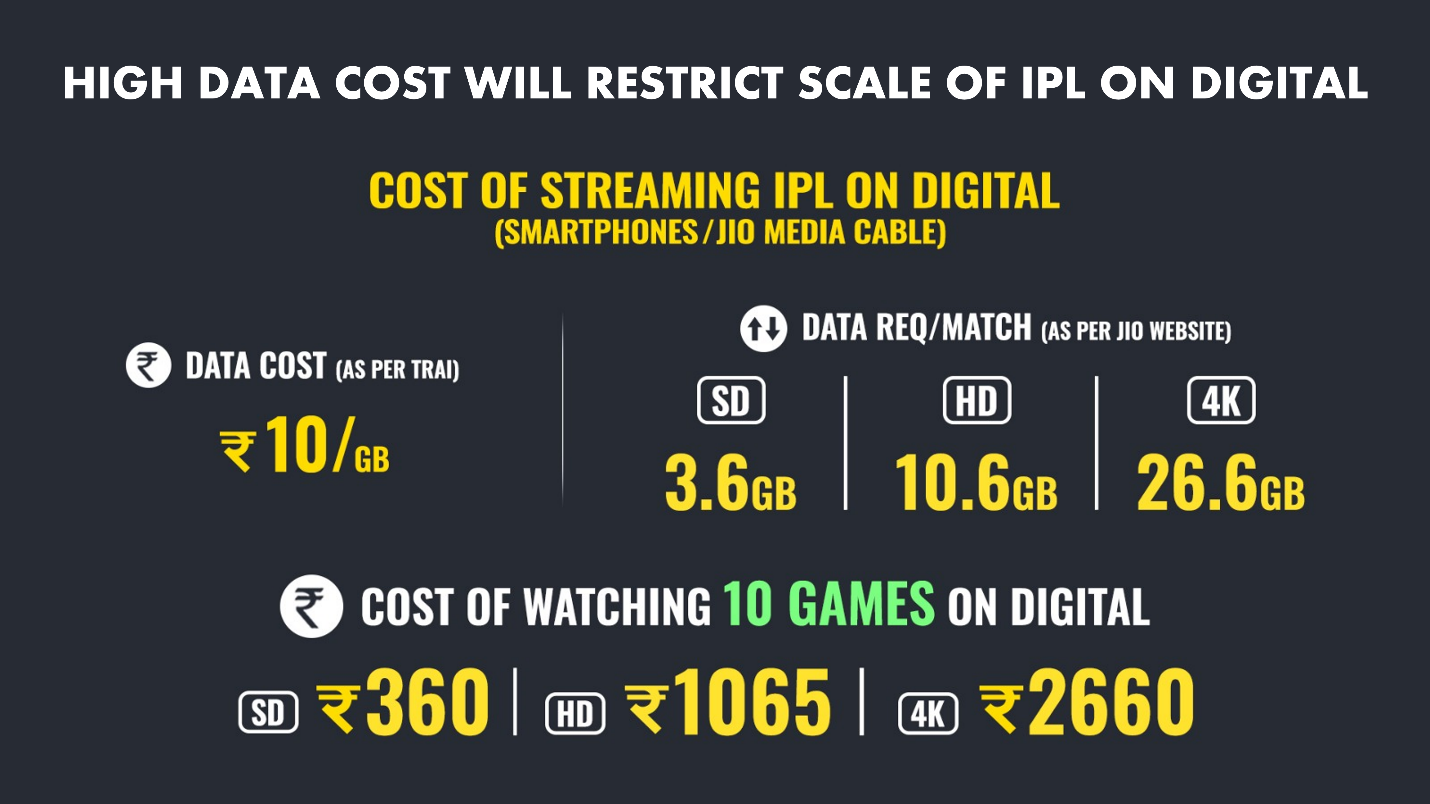

The duration of a match in IPL is 3.5 hours on average and the data required to stream a match ranges from 3.6 GB for standard definition (SD) to a whopping 10.65 GB for 4k resolution. As per TRAI, the cost per GB is Rs 10 in India, which means a viewer will have to pay anything between Rs 35 to Rs 107 just to stream one match of IPL, and if a viewer is to stream even ten matches of IPL, the cost of data would catapult to Rs 350-Rs 1000. This data cost is exorbitant considering the average consumer today pays merely Rs 170/month for data. This means if viewers want to now stream just 10 IPL matches on mobile in the most basic resolution, their monthly mobile bill will increase by 3X at the least. Considering that social media and short form video content accounts for most of the monthly data consumption of a user, it is practically impossible to stream more than a few minutes of an IPL match unless users burn a hole in their pockets further.

Limited Data consumption among Indian consumers

The average data consumption across 2022 averages close to 17-18 GB per month. At best the usage goes up to 22.4 GB on an average, which indicates that streaming of IPL on smartphones will require a 10-15x increase in data consumption and a massive increase in the spending threshold of the average Indian user. Even the top tier of consumers that would account for highest data consumption are consuming only two GB data per day. When compared with the data requirements to watch IPL on digital in a higher resolution, the potential shortfall to meet the requirement among the top tier too is significant.

CTV – More hype less impact

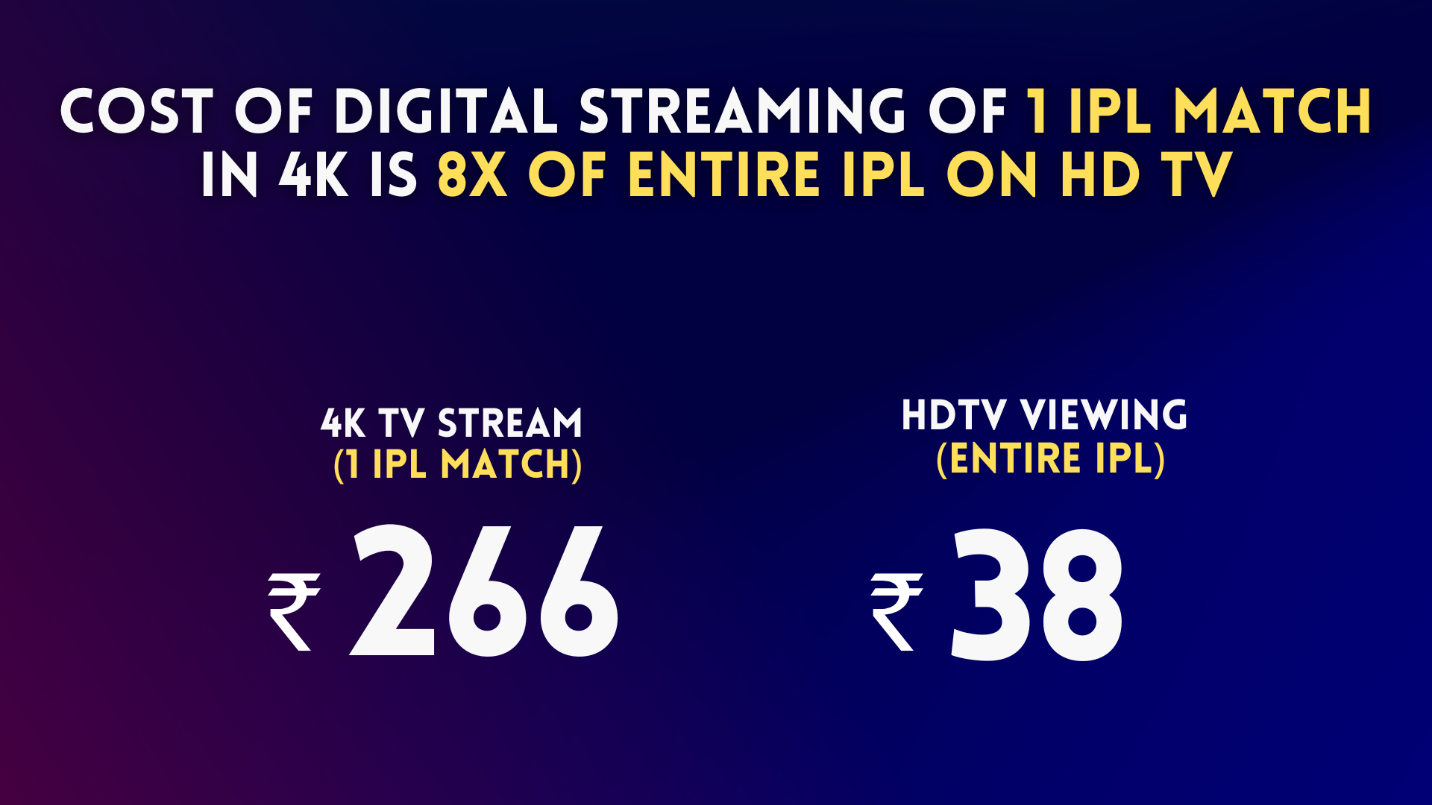

CTV too faces critical challenges that will deter it from scaling during IPL. As it stands, there are two ways in which consumers can experience CTV viewing during IPL. The first is through CTVs powered by wired broadband and the second is by using the Jio Media Cable, where mobile data will be consumed to stream IPL on TV sets. Out of 31 million wired broadband homes in India, only 13 million homes powered by wired broadband are capable of CTV viewing, as per a Crisil report. Even in terms of cost, fiber broadband plans would cost a household anywhere between Rs 1000-2400 to be capable of streaming IPL. The cost of enabling high-speed wired broadband and the lack of scale it stands at currently are the biggest constraints for the digital streaming of IPL. In terms of the Jio Media Cable, the cost of data to power streaming from smartphones is exorbitantly high compared to already available alternatives. To stream one game of IPL in 4k resolution through the Jio Media Cable, viewers will have to pay Rs 266/match, which is astonishingly ~8x the cost of viewing the entire IPL in HD on television. Considering that over 95 per cent CTV homes are also HD homes, it is highly unlikely for CTVs to drive scale on IPL viewing.

Low Cost and Ease of Access Gives TV the Edge

IPL has consistently been a TV phenomenon over the years owing to its high penetration, ease of access as well as low cost of the subscription. The cost of watching the entire IPL in SD or HD is just Rs 38 over two months, which is similar to the cost of streaming just one IPL match in standard definition on smartphones. If the viewer wants to watch HD or 4k on smartphones, the cost compared to TV will be 30x-80x higher.

Even in terms of premium audiences, 95 per cent of CTVs in India have HD subscriptions. Therefore, high data costs and the lag-free experience that TV delivers will deter the scaling of CTV viewing for IPL.

The kind of scale TV offers is unparalleled. TV penetration in India stands at 226 million households and consists of 900 million viewers, a scale that is 2x of digital. Even HD homes in India are 70 million strong, 7x of CTV penetration.