NEW DELHI: For linear television, 2020 was like a ride to hell and back, owing to the Covid2019-induced lockdown. It was the first time that shoots were canned wholesale, there were no new shows running, and advertising volumes hit abysmal lows. All was not doom and gloom – the industry saw meteoric rise in viewership, initially banking on reruns of old classics like Ramayan and Mahabharat, followed by marquee properties like the IPL, KBC, and Bigg Boss making their way to our screens. While this may have resulted in an uptick in subscription revenues, advertising prospects remained stunted through the year. Here’s a quick overview of how advertising fared on linear television in 2020.

The maths of it

The first quarter of FY21 saw the industry incurring huge losses as advertisers pulled out advertising monies as production and supply chains across industries took a big hit.

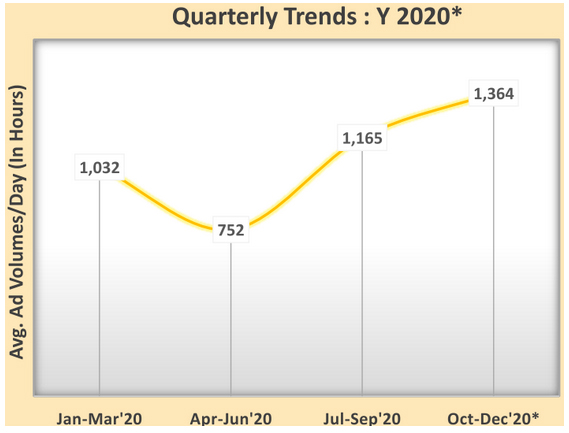

Average ad volumes per day dipped to 752 hours in April-June ‘20 quarter, as compared to 1,032 hours in January-March ’20, according to TAM data. The ad revenues for broadcasters witnessed a year-on-year decline of 59 per cent in Q1 of FY21, as shared by ICRA. Depending on genres, advertisement revenues were impacted by 25-60 per cent (vis-a-vis pre-Covid average monthly revenues) in Q1 FY21. While news and movie genres were on the lower end of the spectrum, with an average decline of 25-30 per cent in advertisement revenues, GECs and sports channels witnessed a sharp 50-60 per cent reduction in advertisement revenues.

This was despite a meteoric rise in TV viewership in those months. BARC data reports a nine per cent increase in TV viewership during January-June ‘20 as compared to the corresponding period last year; the growth was led by the news, kids, and movie channels. Understandably, the viewership declined by three per cent for GECs, given the lack of fresh programming.

The industry started getting back on its feet steadily as lockdown restrictions eased and businesses started moving forward, the IPL and festive season gave it further momentum. The ad volumes in the second half of the year showed outstanding growth. Average ad volumes per day rose by 39 per cent in the fourth quarter compared to average ad volumes of the previous three quarters, TAM data showed.

Caption-- Source: TAM

According to BARC estimates, advertising volumes grew by 10-11 per cent over 2019 during Dussehra and Diwali 2020. Ad volume for Ganesh Chaturthi was up seven per cent over last year. Another study, by TAM, revealed that there were 655 new advertisers who made an appearance on GECs in September-November 2020, as compared to the past two years. This new league of advertisers included names like Facebook, Airtel Payments Bank and WhiteHat Education Technology.

As per ICRA, TV broadcasters saw a strong sequential recovery of 86 per cent in advertising revenue in Q2 FY21. However, it still remained 20 per cent lesser on a year-on-year basis. GECs too regained their popularity.

As expected, the biggest share of this improving pie landed in the IPL’s kitty. Despite the sponsorship rate for the league going down by 25 per cent, the industry is positive that the league would have made 10-15 per cent more in revenues (https://www.indiantelevision.com/mam/media-and-advertising/sponsorship/eventually-ipl-2020-scored-big-with-advertisers-sponsors-201111) as compared to 2019, clocking around Rs 2,000 crore on TV alone. Comprehensively, TV broadcasters in ICRA’s sample set reported a 21 per cent year-on-year decline in revenues in H1 FY21.

On an overall level, the industry has indicated mixed projections for the state of ad revenues for broadcasters in 2020. While Edelweiss has pegged it to grow by 6.5 per cent, KPMG and GroupM are indicating a contraction.

Talking to Indiantelevision.com in April this year, the industry indicated a negative growth for 2020 (https://www.indiantelevision.com/mam/marketing/mam/covid-19-might-push-traditional-advertising-towards-negative-growth-200428).

Madison Media and OOH group CEO Vikram Sakhuja said the advertising growth, which was pinned by his firm at around 10 per cent at the beginning of the year, will take a big hit in this calendar year. “We were expecting around a six per cent growth for traditional and around 28-30 per cent for digital media. However, looking at the current scenario, traditional media might observe a negative growth, while digital will also shrink considerably. We will be lucky if we can see a one-two per cent growth this year.”

The rise of new categories

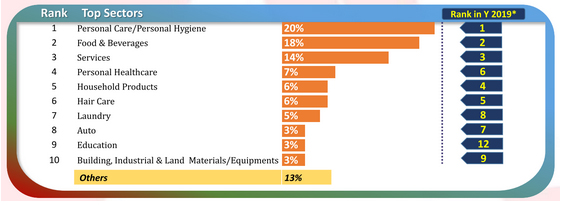

Top ranks of advertisers on television underwent some shuffling as industries dealt with the crisis. As per TAM data, personal care/personal hygiene sector had a 20 per cent share of ad volumes, followed by F&B with 18 per cent share. Education became the only new entrant in the top 10 list of sectors advertising on TV. It was possibly because of the new home education module that people were forced to live with. Ed-tech companies like Byju’s, WhiteHat Jr, and Vedantu advertised heavily on television.

Source: TAM

Additionally, Ecom-media/entertainment/social media moved up five positions to achieve the second spot in leading categories advertising on television.

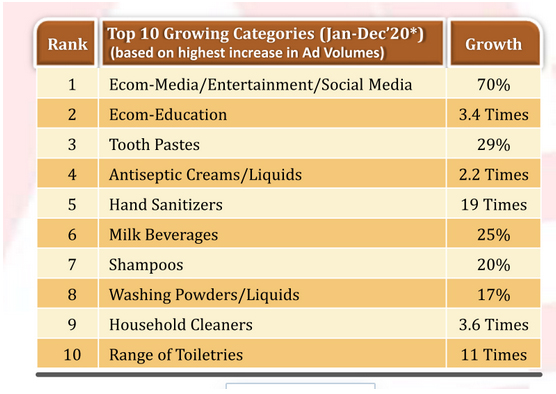

Source: TAM

Hand sanitisers also registered robust growth and it was reflected in the television ad volumes too. Most of the leading exclusive brands in the year belonged to the category, along with social media, ed-tech, and OTT services.

Source: TAM

On the contrary, the FMCG sector that jumped the fence to go digital in 2020 might have taken out some from the TV pie. For instance, India’s largest advertiser Hindustan Unilever spent Rs 1,936 crores in the July-September quarter, 17 per cent less than the corresponding quarter in 2019. While the ad volumes from FMCG brands clung back to pre-Covid levels, it is yet to be seen if the revenues will turn back or not.

The year saw the television industry in a massive flux, struggling to keep up with the rapidly changing state of affairs. While categories like news remained on a positive incline through the year, GECs suffered losses for the most part of it. In terms of ad revenues, it might be clocking much less than what was forecast at the beginning of 2020, but industry projects fair tidings from the second quarter of 2021. It will be interesting to see how the industry fares in the coming year.