BENGALURU: Bharti Airtel Ltd (Airtel) Digital TV services segment reported 7.1 per cent year-on-year (y-o-y) increase, 3.2 per cent y-o-y increase and 4.5 per cent y-o-y increase in operating revenues, EBITDA and EBIT respectively for the quarter ended 31 December 2018 (Q3 2019, quarter, period, under review) as compared to the corresponding year ago quarter. The company’s subscriber base increased 7.6 per cent y-o-y to reach 1.5 crore subscribers as on 31 December 2019.

In the meantime, hit by Mukesh Dhirbhai Amabani’s relentless Reliance Jio Infocomm Ltd juggernaut, Airtel’s own numbers have been falling mainly due to the fall in numbers of its mobile services in India.

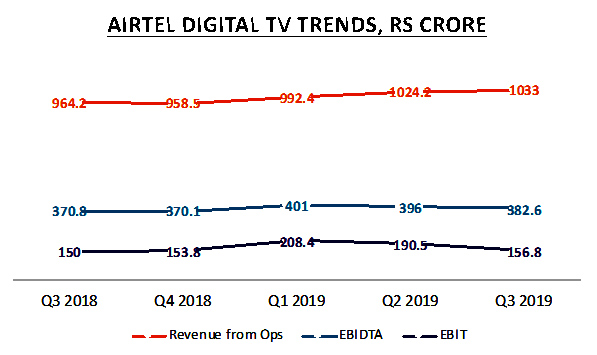

Airtel Digital TV services revenue for the period was Rs 1,033 crore as compared to Rs 964.3 crore for the corresponding year ago period. EBITDA for Q3 2019 was Rs 382.6 crore (37 per cent of operating revenue) as compared to Rs 370.8 crore (38.5 per cent of operating margin in Q3 2018. EBIT was Rs 156.8 crore for the quarter under review as compared to Rs 150 crore for the year ago quarter. Please refer to the figure below for the segment’s financial trends

Airtel has reported increase in its Digital TV subscribers. As mentioned above Airtel Digital TV services subscriber base at the end of Q3 2019 stood at 1.5 crore, up 7.6 per cent y-o-y from 1.3937 crore in Q3 2018, and up 1.5 per cent quarter-on-quarter (q-o-q) from 1.4779 crore in Q2 2019. Subscriber churn per month in the quarter was same as the previous quarter at 1.3 per cent. In the year ago quarter Q3 2018, subscriber churn was 1.2 per cent. Please refer to the figure below for Airtel Digital TV subscriber trends.

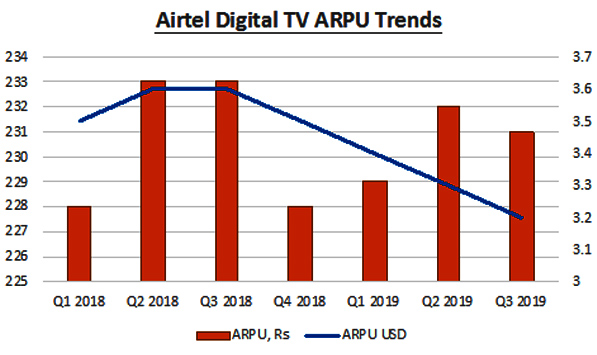

Average revenue per user for the quarter under review was down by Rs 2 in Q3 2019 at Rs 231 as compared to Rs 233 in Q3 2018 and down by Re 1 as compared to the Rs 232 for the immediate trailing quarter. Please refer to the figure below for Airtel Digital TV ARPU trends.

Bharti Airtel numbers

Airtel’s consolidated revenues for Q3 2019 at Rs 20,519 crore grew 1.9 per cent y-o-y (reported increase of 1.0 per cent) on an underlying basis- adjusted for international termination rate reduction.

India revenues for Q3 2019 at Rs 14,768 crore have declined by 2.3 per cent y-o-y (declined 3.5 per cent on reported) on an underlying basis. Mobile revenues have witnessed a y-o-y de-growth of 4.0 per cent on an underlying basis primarily on account of the sustained pricing pressure in India Mobile segment.

In a statement, Airtel MD and CEO of India and South Asia Gopal Vittal, MD said, “Our simplified product portfolio and premium content partnerships have played out well during the quarter, translating into one of our highest ever 4G customers additions of 11 million plus. Our mobile data volume continues to expand, with a y-o-y growth of 190 per cent. We have deployed 24K broadband sites during the quarter and remain committed to invest in capacities ahead of the demand curve and provide a superior customer experience. Effective this quarter, we have modified our customer base measurement to represent only transacting and revenue generating customers. “

In a statement, Airtel’s MD and CEO for Africa’s Raghunath Mandavasaid,

“Airtel Africa’s Gross Revenue grew by 11.2 per cent on a y-o-y basis. Data traffic grew by 61 per cent, voice minutes increased by 25 per cent and Airtel Money throughput grew by 29 per cent on a y-o-y basis. Consequently, EBITDA margin has expanded by 1.7 per cent y-o-y and stood at 37.2 per cent for the quarter. We continue to further invest in strong LTE network to enhance customer experience and build a competitive advantage.”