MUMBAI: They bring us joy with a click, delivering steaming biryanis, comforting gulab jamuns, and all things delightful, right to our doors. But behind every pop notification—'Miss me?' from our favorite desserts—lies a story of grit, ambition, and relentless pursuit. Swiggy, India’s food delivery and quick commerce titan, has filled our carts with convenience, but at a cost that has left its own coffers under strain. In its Q2 FY25 results, unveiled on 3 December 2024, Swiggy showcased an awe-inspiring surge in revenues by 30 per cent YoY to Rs 36,015 million. Yet, this celebratory crescendo is tempered by an echo of concern—net losses have deepened, reflecting the challenges of sustaining growth while keeping an expansive team and ecosystem thriving. It's a tale as flavorful as their marketing, and as complex as their financials—balancing indulgence with accountability.

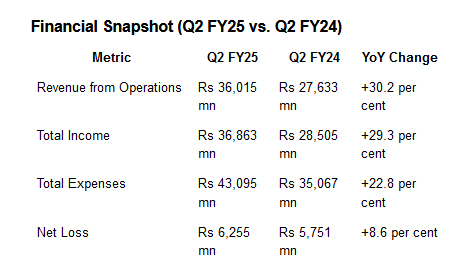

Swiggy's total revenue from operations increased by 30.2 per cent YoY, reaching Rs 36,015 million in Q2 FY25 compared to Rs 27,633 million in Q2 FY24. This leap reflects strong performance across key segments, particularly food delivery and quick commerce. However, the company's consolidated losses stood at Rs 6,255 million for the quarter, marking an 8.6 per cent rise from the Rs 5,751 million loss recorded in the same period last year.

The increase in expenses, driven by marketing, logistics, and employee benefits, strained profitability despite robust revenue growth. Total expenditure for Q2 FY25 amounted to Rs 43,095 million, a 22.8 per cent increase YoY. Swiggy’s continued focus on customer acquisition and brand building weighed heavily on its bottom line.

Key drivers:

● Food Delivery: As Swiggy’s flagship segment, food delivery generated Rs 15,745 million in revenue, reflecting a YoY growth of 22.9 per cent. Enhanced customer loyalty programs and competitive pricing played pivotal roles in this growth.

● Quick Commerce (Instamart): Quick commerce revenues skyrocketed by 135.4 per cent YoY, reaching Rs 4,900 million, emphasising Swiggy's commitment to diversifying its service portfolio. Strategic investments in dark stores and supply chain logistics have fueled this expansion.

● Supply Chain and Distribution: This segment contributed Rs 14,526 million, up 22.0 per cent from the previous year, as Swiggy capitalised on its warehousing and fulfillment network to streamline FMCG distribution.

● Platform Innovations: Revenues from platform innovations, including initiatives like Swiggy Genie, amounted to Rs 253 million but faced a decline from Rs 494 million YoY.

Expansion comes at a cost

Swiggy's aggressive growth strategy comes at a significant cost. Employee benefits rose to Rs 6,073 million in Q2 FY25, up 13.2 per cent YoY, reflecting hiring and retention efforts in a competitive labor market. Delivery charges surged by 32.5 per cent to Rs 10,949 million, as Swiggy expanded operations in Tier II and Tier III cities.

The company's marketing expenses also increased, with advertising and promotional costs totaling Rs 5,371 million, up 8.8 per cent from the previous year. These expenditures underline Swiggy's push to strengthen its market presence amidst fierce competition from rivals like Zomato and Blinkit.

IPO milestones

Swiggy's listing on the NSE and BSE in November 2024 marked a significant milestone. The IPO raised Rs 115,407 million through fresh issues and offer-for-sale components. Proceeds were earmarked for expanding Instamart's operations, enhancing technology infrastructure, and bolstering working capital.

Additionally, Swiggy's investment in its wholly owned subsidiary, Scootsy Logistics, reached Rs 1,600 crore. This infusion aims to optimise supply chain capabilities and support quick commerce scalability.

Swiggy’s outlook hinges on its ability to navigate the profitability challenge. With over 70 per cent of revenues stemming from food delivery, diversifying its income streams is crucial. Quick commerce, which grew phenomenally in Q2 FY25, holds promise but demands continued investment.

The company has also signaled its intent to strengthen customer engagement through tech-driven solutions and personalised services. However, the path to sustainable profitability will require stringent cost controls and efficiency enhancements across its operations.

Swiggy’s Q2 FY25 performance paints a vivid picture of ambition clashing with financial challenges. Swiggy stands at a crossroads, its vision clear but the journey demanding resilience and bold decisions. For now, we wait—with curiosity and anticipation—to see what this culinary trailblazer serves up next in its quest to satisfy appetites and redefine the future of food.