MUMBAI: Remember the days of frantic scrambles for exact change with rickshaw drivers, the despair of handing over a Rs 500 note, and the resigned sigh when left without small notes? Then came the game-changer: Unified Payments Interface (UPI), India's very own digital savior, swooping in like Superman to transform not just transactions but lives — everyday payments into seamless, one-tap solutions. Life has since taken a fast track to convenience, where paying for chai or groceries no longer requires mental mathematics.

Fast forward to 2024, India’s fintech market is now a behemoth, estimated at an eye-watering $111.14 billion, with projections soaring to $421.48 billion by 2029 at a CAGR of 30.55 per cent, according to Mordor Intelligence. It’s a story of rapid growth, innovation, and a market ripe with opportunities.

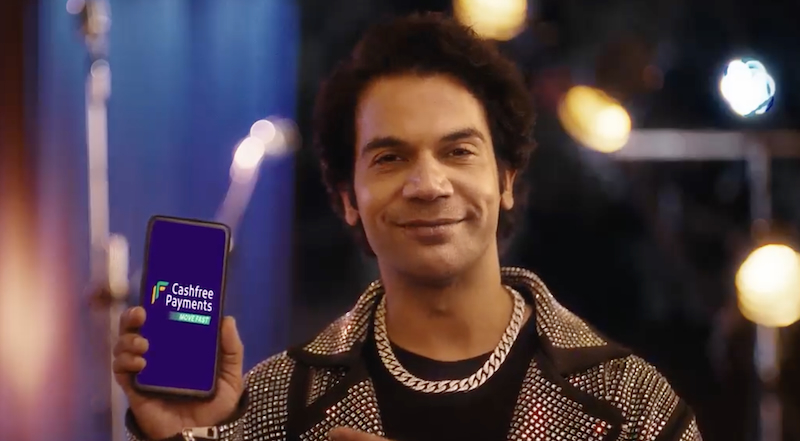

Amid this transformative boom stands Cashfree Payments, a trailblazer reshaping how India transacts. With a bold new tagline, "Move Fast", and a high-octane marketing campaign featuring the versatile Rajkummar Rao (insights in our exclusive earlier piece), Cashfree Payments is running at full throttle to define the future of payments. In an exclusive conversation with Indian Television’s Sreeyom Sil, Cashfree Payments, head & senior director of marketing, Aditi Olemann, dives deep into the strategy, the vision, and the high stakes behind staying ahead in this competitive space.

From nostalgia to numbers, from convenience to cutting-edge marketing, this tete-a-tete with Olemann is your front-row ticket to behind the scenes of the campaign, offering a glimpse into how the brand is shaping India’s payment future.

Curious?

Read on for a story of speed, strategy, and a little bit of magic in the world of fintech.

Edited excerpts

On the reasons why Cashfree Payments chose “Move Fast” as its new tagline.

Since our inception, we’ve prioritised building a future-proof digital payments ecosystem. Speed, security, and seamlessness have always been at the heart of our operations. Over the past decade, we’ve observed that businesses consistently value speed—whether it’s onboarding, transactions, or resolving issues. “Move Fast” encapsulates our commitment to empowering businesses with the agility they need to thrive. This tagline reflects our vision to be a catalyst for growth in a fast-paced, digital-first economy.

On what led to the selection of Rajkummar Rao - who seems like an unconventional choice for a fintech brand.

Rajkummar Rao exemplifies versatility, reliability, and boldness—qualities that mirror our ethos. His career is a testament to taking calculated risks, challenging norms, and delivering impactful performances. At Cashfree Payments, we strive for the same—redefining the fintech landscape with innovative solutions that solve real-world challenges. Rajkummar’s journey aligns perfectly with our narrative of breaking boundaries to create meaningful change. His dynamic persona brings authenticity and energy to our campaign, making the message resonate deeply with our audience.

On how messages are being tailored to different platforms and channels.

Our multi-channel strategy is designed to engage diverse audiences effectively. Collaborating with OML and our internal teams, we’ve created a campaign spanning OOH, digital, social, and print media. For instance, hoardings in startup hubs like Bangalore, Gurugram, and Mumbai target budding entrepreneurs, while digital and social media focus on engaging tech-savvy audiences. Each channel conveys our core message of “Move Fast” while adapting its tone and delivery to suit specific segments, ensuring maximum recall and impact.

On some behind-the-scenes insights into the making of the corporate film.

The corporate film encapsulates our brand’s promise of empowering businesses with speed and agility. Featuring Rajkummar Rao, it combines high-energy visuals with relatable storytelling to depict real-world business scenarios. Our goal was to create a film that is both informative and engaging. Every aspect, from scripting to visuals, was meticulously crafted to highlight our offerings—seamless onboarding, smooth transactions, and unparalleled support. The film reflects the passion and dedication of our team and beautifully conveys the essence of “Move Fast.”

On the specific challenges Cashfree Payments address for businesses.

Businesses face hurdles like delayed issue resolution, fraud risks, and complex compliance requirements. At Cashfree Payments, we tackle these challenges head-on. Our dedicated support teams ensure industry-leading resolution times, while tools like Risk Shield offer proactive fraud monitoring. Additionally, real-time compliance updates keep businesses ahead of regulatory requirements. Our approach blends cutting-edge technology with personalised service, enabling businesses to resolve issues swiftly and focus on scaling their success.

On how the campaign bridges the gap between startups and large enterprises.

Our solutions cater to over six lakh merchants, ranging from startups to large enterprises. For startups, we emphasise simplicity and speed, providing seamless onboarding and intuitive tools. For larger businesses, we focus on advanced capabilities like payment orchestration and fraud monitoring. The “Move Fast” campaign unifies these offerings under a single, impactful message. By showcasing our adaptability and commitment to all business sizes, we aim to reinforce trust and drive adoption across the spectrum.

On the KPIs that will measure the success of this brand refresh.

In the short term, we are focusing on increased brand recall and consideration. Over the long term, key metrics include adoption rates of new services, customer retention, and revenue growth. These KPIs will help us gauge the campaign’s effectiveness in enhancing visibility and delivering sustained value to the business.

On how the campaign simplifies complex fintech concepts for non-technical stakeholders.

We’ve made a conscious effort to translate technical advantages into tangible outcomes that resonate with all stakeholders. For example, faster settlements improve cash flow, while seamless integrations enhance operational efficiency. The campaign uses real-world scenarios and relatable narratives to demonstrate these benefits, ensuring clarity and impact.

On how the brand refresh prepares Cashfree Payments for long-term growth.

This refresh solidifies our position as an agile and forward-thinking partner in the fintech space. By emphasising speed, reliability, and innovation, we’re well-equipped to navigate regulatory changes, technological advancements, and evolving customer expectations. It’s a strategic step towards ensuring resilience and sustained growth in a competitive digital economy.

Follow Us

Follow Us