Mumbai: TIPS Industries Ltd (Tips Music), a leading Indian music label which creates and monetises music, announced its financial results for the quarter & financial year ending 31 March 2023.

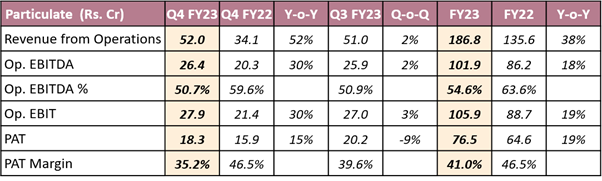

Key financial performance:

Key financial highlights:

1. Highest ever quarterly revenue growth. Revenue for Q4 FY23 was Rs 52 cr, a growth of 52 per cent y-o-y and 2 per cent q-o-q. For FY23 revenues stood at Rs 186.8 cr up by 38 per cent y-o-y.

2. The content cost for the year was Rs 62.4 cr which has risen by 95 per cent over the previous year and for Q4 FY23 the content cost was Rs 19 cr, up 120 per cent y-o-y.

3. For FY23 the company released 896 new songs from which 240 new songs were released during Q4 FY23. Out of 240 new songs, 141 were new film songs and 99 non-film songs.

4. Latest releases including PS-1, performed exceptionally well. Two songs of Freddy have crossed over 55 million views, and the Yo Yo Honey Singh “Yai Re” has crossed over 35 million views.

5. YouTube subscribers now stand at 82.1 million. For FY23 YouTube views were 112.7 billion up 89 per cent y-o-y while for Q4 FY23 views were 33.6 billion, which is a growth of 105 per cent y-o-y.

6. Successfully completed buyback of the maximum permissible amount of Rs 40.1 cr during the year. Also, the board has recommended a dividend of Rs 0.5 per equity share taking the FY23 payout ratio to 60.8 per cent (buyback + dividend).

Commenting on the results, chairman & MD Kumar Taurani said, “I am thrilled to announce that we have had an eventful and successful quarter. We have reported our highest ever quarterly sales growth. This achievement is a result of our dedication to providing must have hits to listeners. On the business front, we have released 240 new songs during the quarter, including 141 new film songs and 99 non-film songs. Our latest releases, including PS-1, have performed exceptionally well. We are proud to say that we have been consistently gaining market share and improving our rankings. We are confident that we will continue to do so in the future and are committed to providing the best products and services to our customers. We have also successfully completed a buyback of the maximum permissible amount in this quarter and recommended a dividend of Rs 0.5/share (post-split), which is the highest ever in our company's history. The buyback and the dividend cumulatively bring our payout ratio to 60.8 per cent for FY23, which is a testament to our commitment to creating value for our shareholders. We are grateful for the support and trust of our stakeholders and are committed to creating sustainable value for all stakeholders.”