Mumbai: The number of pay DTH subscribers has increased from 68.57 million to 68.86 million during the April-June quarter in addition to subscribers of DD Free Dish, said Telecom Regulatory Authority of India (Trai) in its latest ‘Indian Telecom Services Performance Indicators’ report.

Tata Sky continued to maintain the lead in the pay-TV genre with a share of 33.37 per cent, followed by Bharati Telemedia with 25.76 per cent, Dish TV India with 23.45 per cent and Sun Direct TV with 17.41 per cent.

According to the report, Reliance Jio Infocomm was the market leader in the access provider segment with 440.59 million subscribers and 36.64 per cent market share. It added 14.34 million telephone subscribers at the end of June.

Bharti Airtel saw a marginal decline in subscribers from 357.17 million to 357.05 million. Vodafone Idea subscriber base also declined from 284.23 million to 273.88. Similarly, BSNL, MTNL, Tata Teleservices, Reliance Communication, and Quadrant lost subscribers in the quarter.

The internet subscriber base in India grew from 825.30 million to 833.71 million at the end of June. This internet user base comprises 23.58 million wired subscribers and 810.13 million wireless subscribers. Out of the total internet base, 97.09 per cent are using mobile devices and 95.09 per cent are using broadband services to access the internet.

BSNL is the leader in wired internet subscribers with a 25.57 per cent market share and 6.03 million subscribers followed by Bharti Airtel with 3.37 million subscribers. Reliance Jio holds a 59.901 per cent market share in the wireless internet subscriber base with 436.69 million subscribers followed by Bharti Airtel with a 26.76 per cent share.

The top five service areas in terms of internet subscriptions (wired+wireless) are Maharashtra (71.21 million), Andhra Pradesh including Telangana (64.38 million), U.P.(East) (63.50 million), Bihar (56.81 million), and Tamil Nadu (56.41 million).

The broadband internet subscriber base increased from 778.09 million to 792.78 million between March-June. Narrowband internet subscriber base decreased by 13.30 per cent from 47.21 million to 40.93 million.

The top five broadband (wired+wireless) service providers in terms of subscribers are Reliance Jio (439.91 million), Bharti Airtel (197.10 million), Vodafone Idea Ltd (121.42 million), BSNL (22.69 million), and Atria Convergence (1.91 million).

The top five narrowband (wired+wireless) service providers in terms of subscriber base are Bharti Airtel (23.05 million), Vodafone Idea Ltd (14.72 million), BSNL (3.01 million), MTNL (0.09 million), and You Broadband (0.01 million).

In the wired narrowband segment, You Broadband India Pvt Ltd holds 26.23 per cent market share with 0.01 million subscribers followed by Foxtel Telecommunications Pvt. Ltd. with 0.007 million subscribers. In the wireless narrowband segment, Bharti Airtel holds a 56.40 per cent market share with 23.05 million subscribers followed by Vodafone Idea Ltd with 14.72 million subscribers.

The total number of VSAT subscribers decreased from 293,632 to 289,392. Hughes Communication Limited continues to be the market leader with 44.83 per cent share in VSAT with a subscriber base of 129,724 followed by Tatanet Services with 74,704. Hughes Communication Ltd, added the maximum number of VSAT subscribers at 2344 whereas Bharti Airtel, BSNL, and Infotel Satcom saw a decline in their VSAT subscribers during the quarter.

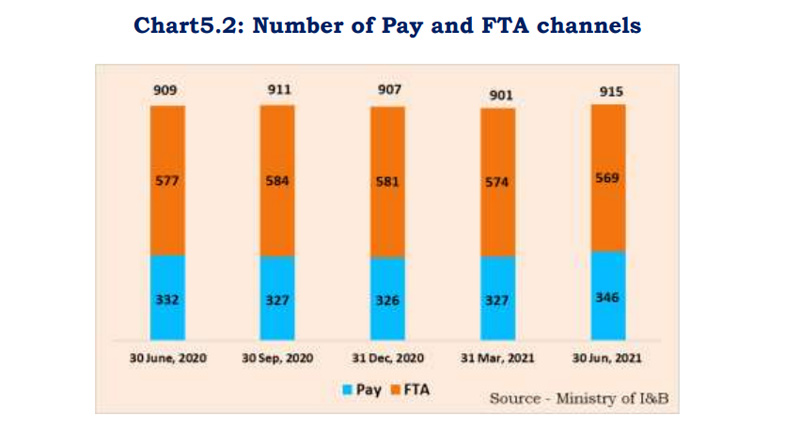

The number of private satellite TV channels increased from 901 to 915. The ministry of information and broadcasting has granted 16 channels permission for uplinking only, 70 for downlinking only and 829 for both uplinking and downlinking. There are 346 pay channels out of which 252 are standard definition and 94 are high-definition channels. The remaining 569 channels are free-to-air.

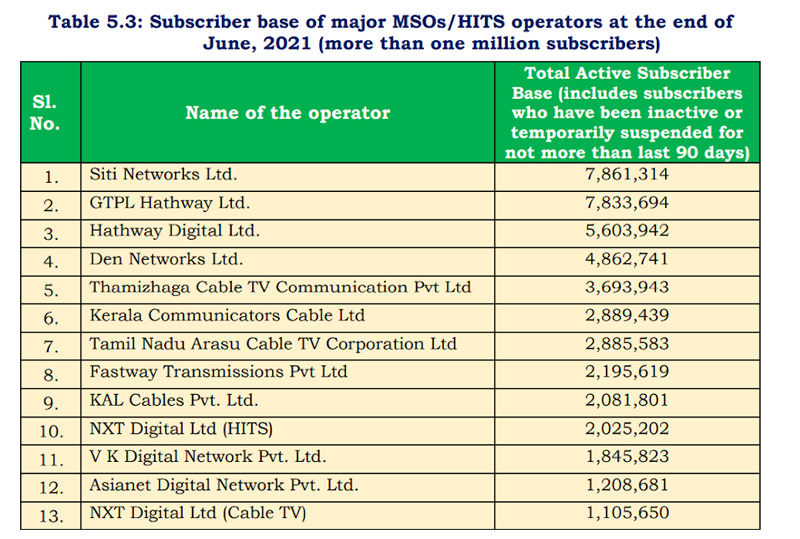

There are 1731 MSOs registered with Trai out of which only 12 MSOs and one HITS operator have a subscriber base greater than 1 million.